Imagine this: One day, as you’re catching up with one of your nonprofit’s most dedicated donors, they explain that they’ve been contemplating what they want to be remembered for. On top of all they’ve done for and with their loved ones, they say, they want to make a lasting impact on your nonprofit’s cause.

Luckily, there is a way that nonprofit donors can leave their mark on the missions they love—through planned giving.

So, what is planned giving?

Planned giving is the process of donating planned gifts, also known as legacy gifts, which are contributions that are arranged in the present and allocated at a future date. Commonly donated through a will or trust, planned gifts are usually granted when a donor passes away.

To more deliberately seek out planned gifts, your nonprofit can set up a planned gift program.

What is a planned gift program?

A planned gift program is a means of cultivating and stewarding strong relationships with planned gift donors. Planned gift programs also serve to support donors throughout the complicated process of enacting a planned gift.

If your nonprofit is ready to empower its donors to make a profound and enduring difference to your mission, you’ll need to educate your supporters about planned giving opportunities and provide the resources and community they need to set up planned gifts. You’ll also need to take special care to make sure your planned giving participants feel seen for their commitments.

Get started by exploring this complete guide to planned gifts!

Ready to uncover your donors’ planned giving potential? Leverage the best tools on the market.

Planned Giving Basics

Why Planned Gifts Matter

Planned Giving Is At The Top of the Donor Pyramid

Along with major gifts, planned gifts are the biggest donations a nonprofit receives. They can both greatly aid your organization and help to continue a loyal donor’s legacy.

Although you won’t immediately receive planned gifts as you would major gifts, their scope and scale make them worth the wait.

On the whole, planned giving represents a large, often untapped, proportion of donor gifts.

Planned Gifts Are Often Overlooked

Many organizations do not actively seek planned gifts, arguing that planned giving is difficult to anticipate because a donor does not have to reveal their intentions in advance of the future gift.

They are regularly regarded as surprises but are too consequential for this practice to be the norm.

By looking for key donor traits (like loyalty) and active promotion, your organization will be on the right track.

Common Planned Giving Terms

Planned Giving Awareness

Bequest Intention

Definition: The bequest intention is the donor’s notice of their intention to make a planned gift. It is not a legally binding commitment but a courtesy so that the nonprofit can expect the future donation.

Quick Tip: Honor your donors who’ve made a bequest intention as you would your major donors, but keep the expenses to a minimum due to the contribution’s non-binding nature.

Bequest Expectancy

Definition: Bequest expectancy is the approximate value of future planned gifts based on your nonprofit’s previous planned giving data. This information helps nonprofits visualize future revenue.

Quick Tip: Nonprofits will approach bequest expectancy differently. Many take an average from a multi-year period (e.g., five years). Just make sure to eliminate any outliers before calculating.

Planned Gift Notification

Definition: This is the official notification that your organization will receive once a planned gift has come to fruition. It might take some time to determine the exact gift amount.

Quick Tip: Since a planned gift notification may not produce a clear figure at first (e.g., the donor pledged a percentage of their estate), you can use data on the donor to gauge an amount.

Types of Planned Giving Assets

Non-Probate Transfer Vehicles

Definition: These “Transfer on Death Deeds” allow planned donors to bypass the probate process (i.e. the process by which a will is proved in court) and give directly to your nonprofit.

Quick Tip: Non-probate transfer vehicles can be used for real estate, savings and checking accounts, money market, and other investment funds (such as retirement or life insurance).

Non-Cash Asset

Definition: A gift that is not cash. These gifts often take the form of securities, life insurance policies, retirement accounts, or real property.

Quick Tip: Non-cash assets are the opposite of cash assets (monetary gifts). Different non-cash assets may require different processes for receiving them or different value assessments for determining their worth.

Real Property

Definition: Real property consists of land, additional property on that land (such as buildings or machinery), and the property rights associated with that land.

Quick Tip: Real property can either be encumbered or unencumbered. You will receive encumbered real property when a third party has some sort of claim to the property (mortgages or other payment plans, for example).

Planned Gift Varieties

Charitable Bequest

Definition: A charitable bequest is an official statement in a will, a trust, or an estate plan that designates a gift to a specific charity.

Quick Tip: Gift amounts are stated in three main ways in charitable bequests. A specific amount is the exact amount of money that a donor will give. A percentage amount is a percentage of what the donor will give (such as a percentage of their estate). A remainder amount is the leftover funds that you’ll receive once the donor has paid their other bequests.

Charitable Gift Annuity

Definition: A charitable gift annuity is when a donor makes an agreement with a nonprofit. The donor gives a large amount of money to the nonprofit. The nonprofit then pays the donor an annual set income from that sum until the pay period ends (usually with the donor’s death). The nonprofit retains the leftover funds.

Quick Tip: Charitable gift annuities can take various forms, and states will have different laws regarding each type of charitable gift annuity. Familiarize yourself with the laws in your state.

Charitable Remainder Trust

Definition: A charitable remainder trust is a trust gifted to a charity that pays an annual amount to the trustee(s). Once the trust is complete, the charity receives the remaining funds. A charitable remainder annuity trust pays an amount each year, while a charitable remainder unitrust pays a percentage of the remaining trust fund.

Quick Tip: In a charitable lead trust, the charity receives an annual amount from the trust fund, and the beneficiaries receive the remainder of the funds when the trust term ends.

Life Insurance

Definition: If a donor has a life insurance policy, they can designate your nonprofit as one of their beneficiaries.

Quick Tip: If your donor decides they no longer need the life insurance policy, they can give the accumulated value to your nonprofit.

Retirement Fund

Definition: A donor can also designate your nonprofit as a beneficiary in their retirement assets, like their IRA, 401(k), or pension.

Quick Tip: Donors should know that they can change their beneficiary designations at any time if their circumstances change.

Retained Life Estates

Definition: With this type of planned gift, a donor gives your nonprofit a piece of real estate that they own and can still use during their lifetime.

Quick Tip: After the donor passes, the piece of real estate becomes your nonprofit’s property, and you can choose to sell or keep it.

Planned Gift Value Assessments

Present Value

Definition: Present value is the current value of a future gift. Before the gift is received, the donor will pledge a certain amount or percentage, which will differ from the value of the gift when it is actually received. The future value of a gift will be worth less than the present value because the value of a gift decreases over time, due to factors such as inflation.

Quick Tip: Currency fluctuations, inflation, and other factors affect value, so having a financial advisor on your team will help you anticipate these value changes.

Fair Market Value

Definition: Fair market value is an estimate of how much an asset or a piece of property is worth, based on the price that a knowledgeable buyer and seller would agree upon in a free market.

Quick Tip: To assess fair market value, you’ll need a knowledgeable team member with expertise regarding your non-cash assets. For example, someone who knows the real estate market and who can determine the quality of a building would be well-equipped to find the fair market value on real property.

Cost Basis

Definition: Cost basis is an asset or property’s price at the time of the original purchase—in other words, it’s what the donor initially paid. When you receive the item as a donation, the value that has accrued since the original purchase may be subject to taxation.

Quick Tip: The value of an asset will be appreciated or depreciated at the time of giving. Appreciated value occurs when the original cost is less than the current value. Depreciated value occurs when the original cost is greater.

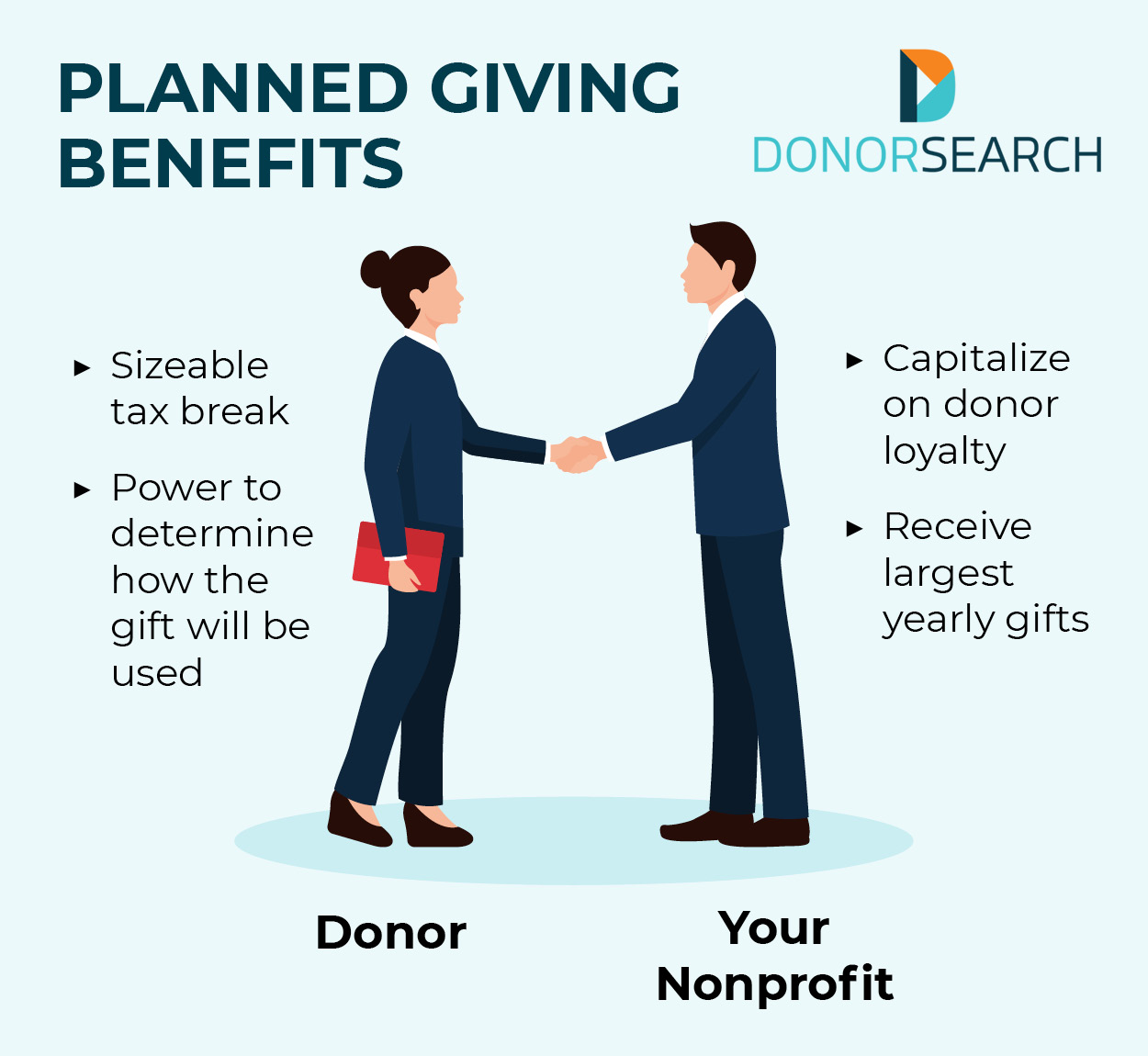

Benefits of Planned Gifts

For Donors

Sizeable Tax Break

From a fiscal perspective, tax breaks are a huge advantage to making a planned giving arrangement. The specifics will vary according to a range of factors, so you’ll need to evaluate the possibilities on a case-by-case basis.

Determining How the Gift Will Be Spent

Donors can give to a certain campaign or to the annual fund, but rarely do they have the chance to detail exactly how their money should be spent within the organization. Planned gifts put complete power in the donor’s hands.

For Nonprofits

Capitalize on Donor Loyalty

Many donors want to give major gifts in their lifetimes but don’t have the financial flexibility to do so. Planned giving lets donors give those large gifts after they have passed away, when living expenses won’t interfere

Receive Largest Yearly Gifts

Historically, planned gifts are up there with major gifts in terms of donation amount. For example, charitable bequests are 2.74 times larger than donors’ lifetime charitable giving. As we’ve said, they’re at the top of the donor pyramid.

Acknowleding Planned Gifts

Donor Recognition Walls

The Basics

Each planned gift deserves to be appreciated and acknowledged. A donor recognition wall can help you honor planned gifts in a permanent, meaningful way.

In the past, donor recognition walls were traditionally basic and uninspired metal plaques. But today’s modern donor recognition walls allow your organization to create beautiful branded displays that honor your donors and convey the narrative of your mission.

Recognizing Planned Gifts

Donor recognition walls help create a meaningful acknowledgment for planned giving. If the planned gift is donated through a will or trust, the display provides a lasting testament to the donor’s legacy that loved ones can visit time and time again.

Planned Gifts vs. Memorial Funds

Planned Gifts

As we’ve discussed, planned gifts are arranged by the donor and set up in advance, often in coordination with the creation of a will.

While a family might donate the money in a memorial fund to their loved one’s favorite charity, memorial funds come from friends and family whereas planned gifts come from a premeditated decision by the donor.

Although donations from memorial funds are certainly welcome and can have a big impact, organizations can’t put plans and programs in place to acquire them the same way they can with planned gifts.

Memorial Funds

Memorial funds are almost always created after someone has passed away.

A memorial fund might be seeded by a one-time fundraiser or it could be a continual fund that is donated to regularly. In many cases, memorial funds are set up to help the family of the person who has passed away cover the costs of a funeral or daily expenses.

In some cases though, the fund is established to make a charitable donation in honor of the person who has passed away, in which case the memorial fund would share some similar traits with a planned gift.

Starting a Planned Giving Program

6 Steps to Launch a Planned Giving Program

Familiarize Yourself and Your Team With Planned Giving Details

Before you can initiate your planned giving program, you’ll need to gain a firm grasp on planned gifts and what they entail.

Once you’ve thoroughly researched planned giving, consider:

- How your program will fit into your nonprofit’s infrastructure

- What resources will be allocated to your planned giving program

- If you’ll be hiring an expert or training a current staff member

- The types of planned gifts your program will actively seek

Next, follow these steps to build out your program:

- Form an advisory committee that includes individuals well-versed in planned giving, such as lawyers, financial planners, and realtors.

- Approach your board members with planned giving opportunities first to build up a base of planned gifts.

- Start accepting and marketing bequests (the simplest type of planned gift) before seeking out more complicated gifts.

Appoint a Planned Gifts Officer

As you continue to strengthen your planned giving program, you’ll need to appoint a planned gifts officer. A planned gifts officer will be responsible for running your planned giving program and cultivating and stewarding relationships with donors to encourage them to make planned gifts.

Here’s an example of a planned gifts officer job description to help you in your journey to appointing your own planned gifts officer:

- Key Responsibilities

- Leading the planned giving program

- Identifying and contacting planned giving prospects

- Initiating program branding and creating marketing materials

- Managing stewardship of planned donors once they’ve committed to a planned gift

- Educating prospective donors (and your staff) about planned giving

- Tracking planned giving data and reporting updates to board members

- Required Experience

- 10+ years of fundraising and/or leadership experience

- Experience managing gifts of $10,000+

- Bachelor’s degree (master’s degrees are usually preferred)

- Track record of securing donations

- Experience with donor databases and data analysis

- Bonus: Background in finance, sales, or marketing!

- Necessary Skills

- The ability to work both independently and in a team setting

- Detailed, in-depth knowledge of planned giving and its terminology

- Clear communication and presentation skills

- Multi-tasking and deadline prioritization

- Ability to analyze data to identify prospects

- Ability to assess the needs of planned donors

Identify Your Prospects

Now that you’ve established your planned giving program, you need to identify your future contributors.

Performing a prospect screening will help you pinpoint your top candidates by taking into account factors such as:

Demographics

- Older in age: Older donors are crucial to approach on three levels. They are much more likely to have a will in place, the finances to donate a planned gift, and a longstanding relationship with your organization.

- Single or widowed: When allocating their assets, people tend to leave the majority of their assets with their spouse. If a donor is single or widowed, they might have more financial flexibility with the allocation of said assets.

- No children: Just like with spouses, often donors will leave their personal fortunes to their children. For donors who are parents but are also interested in planned giving, encourage them to look into charitable gift annuities.

Wealth

- Appreciated property: Appreciated property indicates wealth, which is a key factor in major giving. Additionally, donors might choose to donate their appreciated valuable property instead of a traditional cash contribution.

- Political giving history: Donors who have given large sums of money to political campaigns likely have the means to set up a major gift like a planned gift.

- Business affiliations: By looking into a donor’s business affiliations, you can learn about their career, and, subsequently, their estimated financial situation.

- SEC transactions: Wealthy donors likely own stocks, so looking at publicly-available information from the SEC can help you get a better grasp on their capacity.

Philanthropic History

- Frequent donations to your nonprofit: Past donations are the strongest indicator of future donations. It’s rare to receive a planned gift from a donor who has never given to your cause. Bottom line: planned gift donors are loyal donors.

- Frequent donations to other nonprofits: Donations to other organizations indicate that an individual has general philanthropic tendencies.

Affinity for Your Nonprofit

- Positively affected by your mission: A prospect who has personally received help from your charitable organization may be inspired to show their gratitude and help others in the future. They have firsthand experience in the value of your nonprofit’s services.

- Conviction in your mission: A supporter who consistently volunteers, donates, and promotes your cause to others feels strongly about your work and what you do. These are top signs that a supporter is an advocate for you and would be open to a legacy gift.

- Desire to give beyond current means: Not every planned gift will come from a wealthy person. Supporters may wish they could give more than their finances currently allow. Through bequests in wills, planned gifts let interested parties do just that.

Loyalty is the first defining trait you should zero in on, so remember to focus on prospects who have given to your nonprofit many times over many years.

Generate Marketing Materials

For your planned gifts program to work, people need to know about it!

Spreading awareness about your program will allow future planned gift donors to come to you.

There are several marketing strategies that you can try, but some well-established and effective strategies include:

- Branding your program as a legacy program

- Creating materials for a variety of channels (direct mail, email, etc.)

- Drafting reminders to encourage donors to announce bequest intentions

- Gathering testimonials from other planned givers

As you create your marketing materials, remember to balance the more complicated planned giving terms with a focus on your mission and cause. This will make your planned giving program much more accessible for everyone.

Additionally, remember that your nonprofit doesn’t double as a donor’s financial planner—so don’t cast yourself as such in your marketing materials. Direct donors to the right source to decide what kind of planned giving will work best for their personal financial situation.

Send Out Communications

Creating awareness is your most important task.

Since you’ve identified your most likely planned gifts prospects, you’ll need to send deliberate, personalized communications to these generous donors.

Examples of potential planned gift program communications include:

- Web pages

- Direct mail

- Newsletters

And those are only a few examples of the communication channels that you can and should be using to spread the word about your new program.

Additionally, don’t forget to be sure to have a direct contact that donors can reach out to!

Keep Things Going With Acknowledgments

Planned gifts have a much longer delay than major gifts, so you’ll want to keep your planned gift donors properly stewarded and engaged during the time period between their announcement of their gift and the point that you receive the gift.

Acknowledge how grateful you are for their donation and thank them in numerous ways, treating them as you would a major donor.

In the case where a donor doesn’t alert you to their planned gift, be sure that you properly acknowledge them based on their history with your organization and insight from the donor’s family members.

Planned Giving Ethical Considerations: 2 Frequently Asked Questions

With planned giving, some ethical questions surface. Though ethical dilemmas are rare for most planned giving programs, it’s a good idea to keep these notes in mind so that you’re prepared in the event that you need them.

Are there any ethical issues related to tax breaks associated with planned gifts?

As mentioned, sizable tax breaks often go along with the allocation of a planned gift. A tax break is a win-win situation for donors and nonprofits. Of course, some might consider tax breaks to be tax loopholes.

As long as you and your donor recognize that charity is the most important and primary driving factor behind the planned gift, then you can accept these donations in good conscience.

Do donors offer more than they are realistically capable of donating?

Sometimes, donors will offer an amount that’s too good to be true. This problem will likely never be the result of malicious intent. In fact, it’s the opposite. A donor who wants to do right by your nonprofit will sometimes overestimate their abilities.

Gently guide the donor toward a more reasonable donation. Recognize their good intentions and direct them to a financial advisor to verify their donation.

Final Thoughts

Planned gifts aren’t just gifts that can have a major impact on your nonprofit’s ability to further its mission—they’re also a tool donors can use to leave a lasting legacy. As you work to start up or enhance your nonprofit’s planned giving program, rely on this guide as a resource for foundational knowledge about planned gifts. Now, get out there and start seeking out more planned gifts!

Did you enjoy this comprehensive guide to planned gifts? Continue your learning with these recommended resources:

- 16+ Prospect Research Tools To Find More Donors For Your Org. The right tools can help your nonprofit find more planned gift donors. Learn what you need in your toolkit.

- Creating Perfect Donor Prospect Profiles: A Guide & Template. When it comes to prospecting for planned gift donors, you’ll be up to your ears in donor data. Keep everything organized by creating thorough prospect profiles!

- DonorSearch Ai. DonorSearch is changing the prospect screening game with its AI tools. Learn how predictive modeling can put your organization one step ahead.

Planned gifts move the needle on your mission. Discover how DonorSearch helps nonprofits uncover more opportunities.