Your nonprofit organization needs a deliberate, intentional strategy for securing more support like major gifts. That’s where wealth and philanthropy screening comes in.

At DonorSearch, we bring together your organization’s donor information, data found across charitable giving and wealth databases, and AI predictive modeling to provide you with the most comprehensive and actionable insights to boost your fundraising work.

Here’s a closer look at how it’s done!

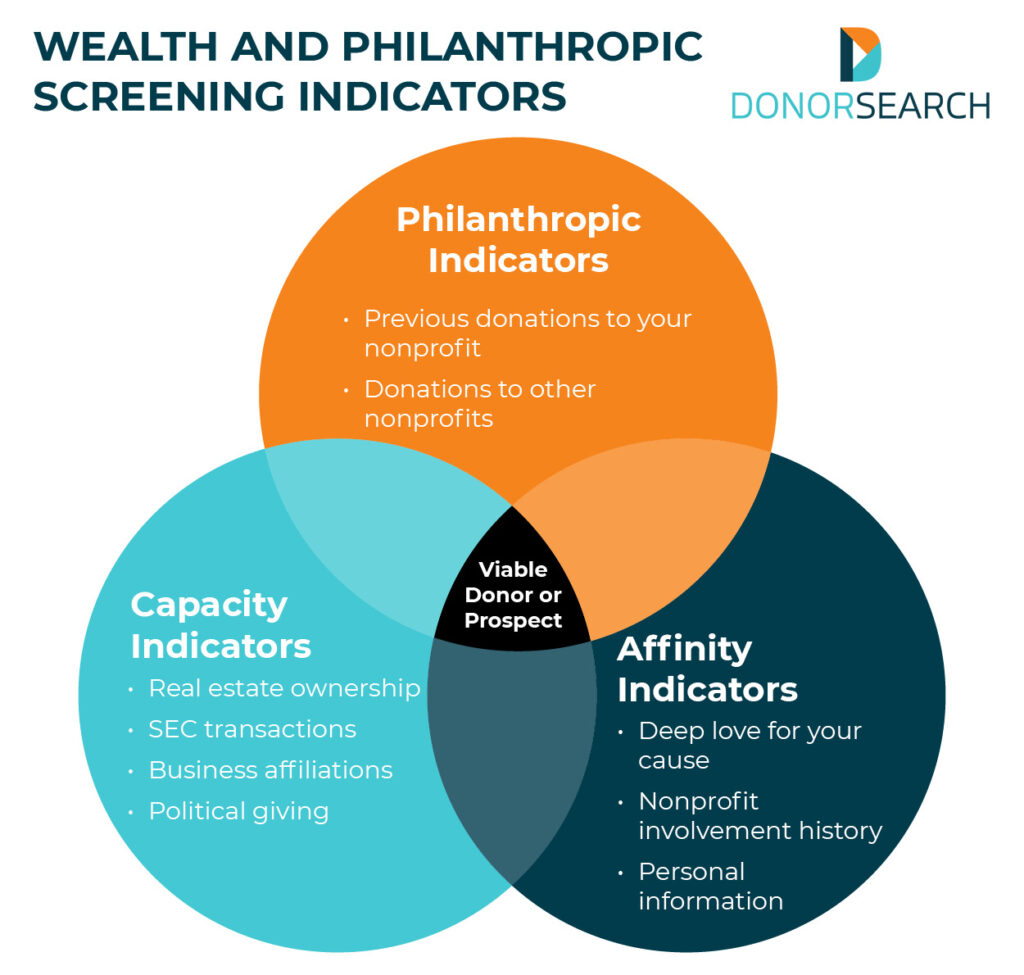

What is Wealth and Philanthropic Screening?

Wealth and philanthropic screening, better known simply as “screening,” is the process of evaluating individuals to discover donors or potential donors that are philanthropically inclined, have an affinity for your specific cause, and have the financial capacity to give.

Traditional screening hones in on wealth details, limiting what you can learn about your donors. At DonorSearch, our philanthropy-focused platform connects giving with capacity, providing you with a fuller picture of who your donors are, what they love about your mission, and how they may be able to contribute to your cause.

Why Screen with DonorSearch?

At DonorSearch, we provide unparalleled wealth and philanthropic screening services and solutions. Here are seven reasons you should work with us:

-

Access to the world’s largest philanthropic database

1Here’s how it works—Your organization provides us with your donor information. We compare that information to the data found in wealth databases and the world’s largest charitable giving database, bringing you fresh insights into your donors and prospects.

-

DonorSearch Ai

2DonorSearch Ai is the most advanced machine learning algorithm ever developed for the nonprofit sector. On top of enriching your data, DonorSearch Ai can quickly recognize patterns and make specific predictions about ready-to-give donors.

-

ProspectView Online analytics and reporting

3ProspectView Online is our easy-to-use research solution that allows you to search, analyze, and prioritize your prospect and donor findings. Discover critical details about your donors and prospects, like business and foundation affiliations, real estate holdings, past giving history, and much more.

-

Top prospect verification to maximize accuracy

4At DonorSearch, we go above and beyond. Our software is the only one of its kind that will manually verify top prospects to maximize screening accuracy. Plus, our team of experts will also review any records you select to ensure that your organization is reaching out to top prospects.

-

Importable and customized data integrations

5Combine your data with ours by leveraging our powerful API. Or, choose a custom integration approach to import data straight into your CRM. Either way, your team will have everything they need, exactly where they need it.

-

Best-in-class client support

6Count on DonorSearch’s client success team to help you at any point in the screening process. We treat every organization we work with like the unique nonprofit they are. Plus, the support you’ll receive from our team won’t cost you extra.

-

The DonorSearch screening secret sauce, 90-100% accuracy

7We don’t cut corners. Our proprietary algorithm and datasets provide your organization with actionable data with an accuracy rate of 90-100%—the highest in the industry!

Our Wealth and Philanthropic Screening Services in Action

We use our skills to help you with your mission. But don’t just take our word for it—check out this client success story featuring the Wildlife Conservation Society.

Get Started With DonorSearch’s Screening Services

You’ve got the fundraising goals and the donor data. We’ve got the wealth and philanthropic screening tools—plus the expertise—to help take your fundraising to new heights. What are you waiting for?