Major Gifts: A Guide to Securing Large Donations

When it comes to collecting donations for your nonprofit, you know that every gift counts—whether it’s a monthly donation of $10 or a one-time major gift of $1 million. But those major gifts are harder to come by, and for your organization to secure them, you’ll need a dedicated major gifts strategy.

Devoting time and attention to your major gifts strategy is well worth it. After all, these are the largest donations your nonprofit receives and can have a powerful impact on your organization’s ability to complete large-scale projects, increase the size of your internal team, or level up your programming.

To optimize your nonprofit’s major gifts strategy, you’ll need a solid understanding of what major gifts are and how to target the best prospective major donors. We’ll cover everything you need to know in this guide, including:

- What is a major gift?

- The Major Gift Fundraising Cycle Explained

- How to Start a Major Gifts Program: 6 Steps

- Major Gifts Program Best Practices

Whether your organization is aspiring to start a major gifts program, or you want to make your current program more robust, this is the guide for you. It will set you up to build long-lasting relationships with major donors and secure gifts that help you spread your cause to your community. Let’s get started!

What is a major gift?

Major gifts are the largest donations an organization receives. What a major gift looks like for your nonprofit, however, will likely depend on a variety of factors, such as your organization’s size, fundraising history, and average donation amount. You can determine your organization’s major gift threshold or range by doing the following:

- Create a list of all donors and donations from the past year, with the largest gifts at the top.

- Take the average of the top three or top five largest gifts you’ve received in the past year.

- This average gives your major gift threshold, a cut-off point to help you identify your major donors’ contributions.

For some organizations, $2,000 might be a major contribution, while others might have a major gift threshold of $100,000. Note that your threshold can change as your organization and its community of supporters grows.

Why are major gifts important to nonprofits?

In general, 80% of donations come from just 20% of donors—your major donors! Because these gifts make up such a large chunk of your fundraising revenue every year, they’re one of the biggest driving forces behind your ability to enact greater change for more people.

This is why you have to approach major donor cultivation with care. From the time you discover a prospect to the time you ask for a donation (and beyond), you’ll need to prioritize building a strong relationship with that prospect, making it clear to them that your organization values them and their support.

The Major Gift Fundraising Cycle Explained

The major gift fundraising process is broken into four distinct phases: identification, cultivation, solicitation, and stewardship. This fundraising cycle helps you find your prospects in and beyond your community of supporters, then lead them to become dedicated major donors for your cause.

Let’s walk through each phase in more detail.

1. Major Donor Identification

To increase your major gift revenue, you first need to identify potential major gift prospects. Since major gifts make up a large part of your overall funds raised, it’s vital that organizations invest time into pinpointing these prospects.

Prospect identification, also known as prospect research, is the process of scanning the individuals currently in your donor database and beyond for wealth and philanthropic indicators. Doing so reveals both a prospect’s financial capacity to make a major contribution and their affinity or interest in your cause. Those who have both strong wealth and philanthropic indicators are your top prospective major donors that your organization can begin stewarding.

Let’s take a closer look at both types of indicators so that you know what you’ll be screening for.

Wealth (Capacity) Indicators

Wealth indicators are what people typically think about when considering candidates for major giving. Wealth indicators (or markers) are signals of someone’s financial capacity to give at the level that your organization considers to be a major gift. These are some of the most common capacity markers:

- Real estate ownership: Real estate ownership can indicate wealth. After all, an individual who owns more than $2 million worth of real estate is 17 times more likely to give philanthropically than the average person.

- Stock ownership: Not only can stock ownership give you an idea of a donor’s potential ability to give, but it also opens up a possibility for donations in the form of stock. This adds another unique way to give and can be more beneficial (if the stock is successful!) in the long run.

- Political giving: Information about political contributions is publicly accessible. Look at your supporters’ political giving histories for further insight into potential philanthropic giving capacity. Studies have shown that donors who give over $2,500 in FEC and charitable campaigns are 14 times more likely to contribute to a nonprofit than those who do not.

When you take a look at wealth indicators like these, you can better understand a prospect’s ability to give. This information also empowers you to make informed fundraising asks that donors will likely say yes to.

Philanthropic (Affinity) Indicators

Philanthropic indicators illustrate a prospect’s inclination towards charitable work in a general sense, as well as towards your specific mission.

Logically, it makes sense that a donor who has given in the past, has been involved recently and frequently, or has donated large sums over time is highly likely to donate a major gift in the future. That’s why these charitable markers are most commonly used to determine a prospect’s affinity to give:

- Past giving: It’s a good idea to look at your supporters’ past giving history to your cause and similar causes (if they have one). Donors who gave between $5K and $10K to a nonprofit in the past are five times more likely to continue donating charitably.

- Nonprofit involvement: Determine if any of your supporters are actively involved with your organization or other nonprofits. Whether as a foundation trustee, a director, a board member, or a volunteer, someone who has been directly involved with nonprofits (especially those with similar missions to your own) is probably more inclined to give to your organization than a prospect who hasn’t.

- Personal information: Your prospects’ backgrounds can also influence their affinity for your cause. Maybe their values align with your organization’s values, or they’ve been personally impacted by your work and want to give back.

Although no philanthropic indicators can guarantee that an individual will make a major gift, examining these markers is a great way to narrow down your list of potential prospects to the best possible candidates.

As you identify these indicators, as well as other information about prospective donors, create prospect profiles that you can use as a living resource to compile everything you know about individual prospects. Doing so will help streamline the cultivation and solicitation processes, and will help your nonprofit stay organized, especially if you’re following a gift range chart during a large-scale campaign.

2. Major Donor Cultivation

Major donor cultivation involves your major gifts team connecting with prospects and learning more about each one. When your team goes through this process, the eventual donation solicitation is more informed and better resonates with prospects. Here are a few of our favorite ideas for cultivating relationships with each prospective major donor you identify:

- Schedule a get-to-know-you visit. The get-to-know-you visit is one of the most crucial steps in the prospect cultivation phase. Major giving is a very personal process, and one-on-one meetings build the foundation for meaningful relationships with your potential major gift donors. Send over some materials for the prospect to review beforehand, such as your most recent annual report.

- Invite them to meet with your organization’s leaders. Hosting an exclusive meet-and-greet with your executive director, board members, and other key members of leadership is a great way to introduce a prospect to your team, mission, and needs.

- Invite them to a VIP event. Small, exclusive, and personal events show major gift prospects that they are not just donors, but that they also play a key role in serving your mission. Informational luncheons offer a casual way to educate prospects about major giving without being too formal. Keep your information action-driven, explaining exactly how major donations can be used to further your cause and achieve tangible objectives.

- Provide an office tour. Show potential donors what you’re all about, what you’re doing on the ground, and how you’re operating in the day-to-day with a tour of your office or facility. This solidifies a donor’s interest in giving a substantial amount to your nonprofit by providing a tangible look at your operations.

Focusing on cultivation before diving directly into a major gift solicitation is critical for ensuring that the prospective giver feels like a key partner with your organization, not an ATM machine. With proper cultivation, your prospects can learn more about your nonprofit, your mission, and what your fundraising needs entail before deciding how they will contribute.

3. Major Donor Solicitation

Once you’ve identified your prospects and taken some time to cultivate relationships with them, you can prepare your donation request. Consider the following best practices for making an effective donation solicitation:

- Account for what you’ve learned. The more you know about your prospects, the better equipped you’ll be to make an ask. For example, by leveraging information gathered through prospect research and wealth screening, you can determine a reasonable amount to request. Or, you might use what you’ve learned about their values and ask for a major donation to go to a specific program you know they’re passionate about.

- Prepare for the conversation beforehand. You’ll need to put in some time and effort to be able to make your case for why the donor should support your cause. To do so, you can gather resources to better communicate the seriousness of your needs. You can even plan out your half of the conversation and practice anticipating what the donor may say in response so you’re prepared for any scenario.

- Know your next steps. Have a plan in place to follow up after your ask. Depending on your donor’s response, you may need to confirm a donation, send more information, or try a new approach. You’ll also want to be sure you have reliable contact information and notes from the meeting.

This part of the major gift fundraising cycle can be challenging. Go into your conversations with the expectation of negotiation. Begin your ask by making your highest request first. Whittle down your original request until both you and your donor feel comfortable. And if your donor is unable to say yes to a donation request now, don’t worry. This doesn’t mean they won’t be willing or able to give some time in the near future!

4. Major Donor Stewardship

Once your donor has submitted their major gift, it’s critical that you continue to build and prioritize that relationship. These stewardship ideas can help you retain major donors and create a more sustainable major giving program overall:

- Correlate gratitude with contributions. A successful stewardship strategy is about matching the level of commitment and enthusiasm that a major gift signifies. Usually, that’s a lot more than a single, personalized acknowledgment. To appreciate major donors well means curating experiences and opportunities to thank and celebrate your major gift donors on multiple occasions. A lot of the same donor acknowledgment principles do apply, just on a grander scale.

- Don’t count major donors out as repeat givers. One might think that if a donor has already contributed a significant sum, they would no longer be interested in giving further. But this isn’t necessarily the case! Proper stewardship efforts increase the retention of major gift donors and encourage them to stick around for the long run. Plus, this allows you to build on all the effort you’ve already put in.

- Communicate additional opportunities for support. For example, nothing gets donors as excited or invested in your organization as getting hands-on with your work. Volunteer opportunities are great ways to engage your major gift donors in a fun and meaningful way. And when you leverage corporate volunteer grants, you might even get an additional donation out of it!

- Show major donors their ROI. Because they’re giving a substantial sum to your organization, major donors understandably want to know exactly how their money will be used. That’s where communicating their ROI (return on investment) is critical. Show them the nitty-gritty, day-to-day details of the work and projects impacted by their contribution. This way, they can better visualize their financial support in practice.

Major donor stewardship is the longest part of the major gift fundraising cycle, and the most important for securing continued support from your major donors. This step also reminds fundraisers that major giving goes beyond receiving a check—it’s also a tool for growing a community of committed supporters who can help you move your mission forward.

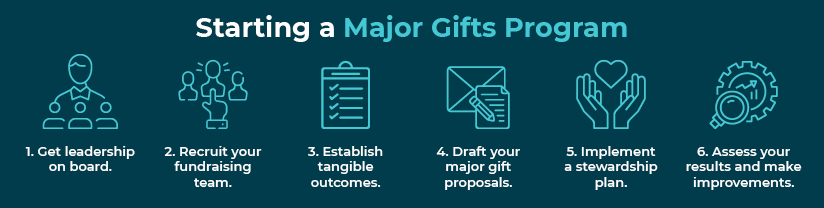

How to Start Your Major Gifts Program: 6 Steps

If you’re looking to start a major gifts program for the first time, the process may seem overwhelming. By following these eight steps, you’ll be securing major gifts in no time.

1. Get leadership on board.

Major gift efforts require everyone on your team to be involved in some way, shape, or form. So you’ll need as much support from your leadership team as possible.

As previously discussed, a great technique for courting major donors is to introduce them to your organization’s executive director or board chair. Your leadership team likely has valuable major donor connections as well and may be able to start some conversations with prospects.

But to do so, you need to make sure your organization’s leaders are on board from the get-go.

2. Recruit your fundraising team.

In addition to having your leadership on board, you’ll also want to build a major gift team, composed of supportive board members, fundraisers, prospect researchers, and even some marketers. And, of course, you’ll need a major gift officer (MGO) to lead the charge. Some organizations may be able to assemble this team with the staff already on board, while others may need to hire for positions like MGO.

Your major gifts team will coordinate the process of identifying and building relationships with prospects who have the capacity and affinity to contribute a major gift. Other key responsibilities might include:

- Determining your organization’s major gift threshold

- Identifying prospects and selecting the best candidates for cultivation

- Soliciting major donors

- Designing a stewardship program

For maximum impact, the individuals on this team should have an extensive familiarity with fundraising, excellent communication skills, a willingness to power through challenges, and a deep passion for your cause.

3. Establish tangible outcomes.

When a major donor gives to your organization, they expect to see tangible results from that contribution. They also might expect some kind of program perks. Incentives for donating never hurt! For instance, if a major gift donor gives a significant contribution to your capital campaign, they may want to have the opportunity to name the building they’re helping fund.

Be sure to communicate these outcomes and incentives beforehand so that prospective donors know what to expect.

4. Draft your major gift proposals.

At this point, your team will be in the midst of the identification and cultivation steps of the major gift fundraising cycle. That means that it’s time to begin drafting your major gift proposals. Here are some tips that can assist you in making the ask:

- Personalize your appeal. Leverage the relationship you’ve built with your major donor to craft the most effective proposal possible. Make sure to use your major gift donors’ preferred names in letters, emails, and in-person conversations. Use their desired titles and pay attention to the level of formality that they prefer.

- Summarize the options. Present your major donors with a few different campaigns or programs that their gift can support. These options will allow the supporter to give to the part of your cause they’re most passionate about. Guide your donor toward high levels of need, but make it clear that they have the option to spend their money as they see fit.

- Align your goals. Your donor is already acquainted with your organization and its cause. Now, explain how the donor fits into the bigger picture by showing how their specific interests align with your nonprofit’s goals. Once you’ve determined your donor’s philanthropic interests and objectives, show them how they can serve those interests through your nonprofit.

- Make a direct, specific ask. Use the data you’ve compiled to persuade your major prospect to contribute. You should know from your research what their giving capacity is so that you can make an informed and accurate request. Make a direct ask that includes the amount you’re seeking, the program that needs the donation, and why this particular program requires this gift.

Request that your prospect researchers compile profiles on your major gift candidates with recommended asks. Then, divide the profiles among your fundraising team. Each team member should work in conjunction with your board and marketers to create a presentation that is personalized for each of the major gift prospects.

5. Implement a stewardship plan.

Major gift donors invest a lot into your organization. It only makes sense to reciprocate and invest back into your donors as well.

Because there likely aren’t an overwhelming number of major gift donors within most donor pools, you should absolutely take the time to cultivate meaningful relationships with each and every one of them. This is also the best way to ensure long-lasting support!

Stewardship is one of the most important steps in the major giving process, so make sure you have a firm plan in place for how you maintain relationships after the gift has been made.

6. Assess your results and make improvements.

It’s always a good idea to set and evaluate key performance indicators (KPIs) when implementing any sort of fundraising strategy. It’s especially important to do so when you’re going through the major gift acquisition process.

Although the KPIs you track will depend on your organization’s goals and chosen strategies, many nonprofits choose to assess return on investment, gifts secured, average gift size, and average giving capacity. That’s because all of these metrics help indicate the success of your major gift strategy and its impact on your overall fundraising.

With these metrics in mind, you can assess your existing campaign and identify improvement opportunities for the future, such as investing in better fundraising software.

Major Gifts Program Best Practices

Once your nonprofit has its major gifts program up and running, you can fine-tune your strategy to pull in more major donations. These best practices will help you take your program to the next level!

Integrate major gifts into overall fundraising.

A major gifts program is likely to be most successful if it integrates seamlessly with your overall fundraising approach. As a starting point, these three aspects of your fundraising strategy can perfectly align with your major gifts efforts:

- Planned giving: Planned gift and major gift prospects share some similar traits. For instance, both often have long-term relationships with your organization and proven connections to philanthropic work associated with your mission. They also often have similar financial giving capacities. However, planned gifts are simply promised at a later date, often as a part of a will when a supporter passes away. Because of the shared predictors, it’s important to compare respective donor pools for the giving types.

- Annual giving: A successful annual fundraising strategy emphasizes supporting existing relationships. Because of this, your annual fund donors are some of your nonprofit’s most dedicated supporters. Your team should look towards annual givers when identifying major giving prospects. Once you identify a prospect with the right financial capacity and a proven record of annual fundraising support, make your solicitation!

- Capital campaigns: During a capital campaign’s quiet phase (before the fundraising effort is publicly promoted), the whole team works diligently to secure major gifts. In fact, approximately 60% of the average campaign’s total is raised during that major gift-centric phase. As such, a dedicated major gift solicitation strategy is absolutely crucial for getting a strong start to a capital campaign.

Folding your major gifts strategy into your day-to-day fundraising efforts will encourage your team to prioritize it in their everyday work. Focusing on these three areas will give you a solid foundation to build on, but brainstorm other ways to make major gifts part of your regular routine

Invest in major gift fundraising tools.

Like any fundraising strategy, having the right tools can drastically simplify the process while maximizing collected revenue. While there is a wide range of software and resources to choose from, these are the most critical options to consider.

Donor Database

From identification through solicitation processes, your organization will be presented with tons of new data. Nonprofits with the expertise to effectively manage that data are the ones that have truly successful major gift programs.

The first step of managing your donor data is having a comprehensive major giving CRM, so make sure you choose the right software for your organization.

Prospect Research Software

To design an impactful major gift program, you’ll need to conduct extensive prospect research. The more research you put in and the more data you’re able to compile, the better prepared your program will be. As a result, you’ll need more support and tools to maximize your efforts.

Luckily, with the help of a prospect research screening tool, you can drastically cut down on the time your team spends researching, freeing them up to focus on cultivation, solicitation, and stewardship.

Look for a software solution (like DonorSearch) that also offers you a mobile-responsive view of your prospects so that you can stay updated on the go. This will help you brush up on information as you prepare for in-person meetings with prospects.

Gift Range Chart

Helpful in mapping out the gift amounts you’re aiming for, major gift range charts offer a great way to represent how your team should approach your fundraising goal in a visual format. They’re especially important if your team is conducting a capital campaign and you’re working to reach a certain threshold before you go public with your campaign.

A major gift chart tells you how many gifts you need to acquire at various giving levels to reach your goal. For instance, if your nonprofit wants to raise $100,000, you may decide that you need one $50,000 gift, two $10,000 gifts, four $5,000 gifts, and ten $1,000 gifts.

Matching Gift Software

Some companies offer gift matching for the donations their employees give to charitable organizations. And while most employers match at a 1:1 ratio, some match gifts at a 2:1 or even 3:1 ratio.

The best part about matching gifts is that donors don’t have to spend a cent more to boost the impact of their gift. But to take advantage of their employers’ matching gift programs, they’ll need to be able to check their eligibility. Invest in a matching gift tool so that you can investigate donors’ eligibility during the identification process. You should also add the tool to your online donation page so all donors can submit their matching information to their employers. Don’t leave extra cash on the table!

AI Solutions

Fundraising tools powered by artificial intelligence (AI) have become increasingly popular among nonprofits in recent years because they improve accuracy and promote innovation while saving time and resources. There are two main types of AI solutions your organization can leverage to modernize and optimize its major gift strategy:

- Predictive AI tools use machine learning to model data and deliver intelligent fundraising insights about prospects’ likelihood of engaging with your nonprofit. For instance, DonorSearch Ai and DonorSearch Enhanced Core score each potential donor based on probabilities such as response to appeals, acquisition, retention, conversion to sustainer status, upgrade, and lifetime value. This way, your team can understand who your top prospects are and prioritize outreach efforts accordingly.

- Generative AI tools streamline fundraising content creation so your nonprofit can develop custom outreach materials more efficiently. Some of these solutions generate supporter-facing content like email copy and direct mail messages (such as DonorSearch Ai + Momentum, which uses individual prospect data to tailor content and matches your gift officers’ writing style in its outputs). Other tools create detailed prospect reports for your team to reference while cultivating donors (like ProspectView Online 2).

As your organization incorporates these AI solutions into its major gift fundraising strategy, commit to using them responsibly—i.e., fairly, transparently, and sustainably—to prevent associated risks and maximize their benefits.

Track your major gift fundraising metrics.

What better way to improve your existing efforts than keeping detailed track of your progress and determining where you can optimize your strategy? Consider tracking the following fundraising metrics to measure the success of your major gifts program:

- Major gift program ROI: This metric tracks the fundraising profit relative to its costs. Specifically, it calculates how much money you raised per every dollar spent. To calculate, simply divide the net revenue of your major gift efforts by the total cost of the program. If the number is greater than 1, you’ve made a profit.

- Average major gift size: The average major gift size is simply the average amount of donated money that qualifies as a major gift. To calculate, divide your revenue from a certain time period or event by the total number of major gifts in that same frame.

- Major donor retention rate: Your major donor retention rate is the percentage of recurring major donors over a certain period of time. Be sure to update your donor information frequently so that you can identify donors who are no longer active. To calculate, divide the number of recurring major donors by the total number of major donors. Then, multiply by 100 to view the metric as a percentage.

- Average giving capacity: Giving capacity is an informed estimate of how much each donor can give and can help you to make more targeted, accurate requests for donations. Compare your average giving capacity to your average major gift size to ensure there isn’t a sizable discrepancy.

- Major gift asks made: This metric tracks the number of times your major gift officers have asked for a donation. Keep a running tally of your asks within your donor profiles. Tracking asks made will ensure that you reach your target number of asks without asking the same donor too often.

To make the most of these data points, be sure to continuously track them over time to determine whether your major gifts program is growing overall. If not, consider making the necessary adjustments to get your program back on track.

Final Thoughts

Major gifts can have a significant impact on your organization, its programming, and the mission you’re striving to achieve. However, they tend to take a bit more time, planning, and resources to secure than a typical-sized donation.

Whether you’re launching a major gifts fundraising program for the first time or seeking to optimize an existing plan, the tips, practices, and resources discussed in this guide are sure to help. Happy fundraising!

Wanting to do some more reading? Check out these other great resources from the team at DonorSearch:

- AI For Nonprofits: Everything Your Org Needs to Know. AI can help your nonprofit find major gift prospects (and so much more!). Learn all the details in this guide.

- Legacy Gifts: Taking Your Org’s Strategy to New Heights. A legacy giving program can help your donors leave a lasting impression on your cause. Learn more in this article.

- Wealth and Philanthropic Screening by DonorSearch. At DonorSearch, we believe in taking a comprehensive approach to identifying prospects. Learn more in this quick guide.